Banco Estado APK 25M+ Users Secure Banking App

Millions of people today demand faster, safer, and more reliable ways to manage their money. Banco Estado APK responds to this need by transforming your Android device into a secure banking hub. Before exploring its core features, let’s understand why this app has become one of the most trusted digital finance solutions in Latin America.

What Is Banco Estado APK?

When people think of mobile banking in Chile, Banco Estado APK stands out as the official app from BancoEstado, the country’s state-owned bank. With over 25 million downloads, it is not only the most popular banking app in Chile but also a benchmark in digital financial services across the region.

The app’s design centers on making financial management simple. Whether you want to pay bills, send money to family, manage savings, or purchase transport tickets, you can do it all from one secure interface. It eliminates the need to carry multiple cards or visit a branch for everyday transactions.

Some technical details make it even more appealing:

-

APK file size: Around 79.5 MB, light enough for most devices.

-

Compatibility: Runs on Android 6.0 and above.

-

No ads: 100% clean interface without intrusive banners or promotions.

-

Free to use: No hidden costs for downloading or using the app.

The app was built with inclusivity in mind. For people in urban areas, it saves time and avoids long queues at branches. For rural communities, where physical bank offices are scarce, Banco Estado APK is a lifeline that connects users to vital financial services. This mix of convenience and inclusiveness explains why it has become one of the most trusted names in mobile finance.

Why 25M+ Users Trust Banco Estado APK

It’s one thing for an app to exist, but another to earn 25 million active downloads. This figure is not just impressive—it’s evidence of massive adoption and deep trust. Users across Chile have chosen Banco Estado APK because it solves key frustrations in traditional banking:

-

Endless queues at physical branches.

-

Restricted opening hours that don’t fit modern lifestyles.

-

Limited services in small towns and rural zones.

With Banco Estado APK, these barriers vanish. According to recent data, the app averaged 7,400 new downloads per day in the last month alone, proving that adoption is steady and growing.

Another major factor in building trust is the fact that BancoEstado is a government-backed institution. For many users, this represents legitimacy, credibility, and added security. Unlike experimental fintech startups, this app isn’t just another digital wallet—it’s an extension of Chile’s national banking infrastructure.

The app also has significant social proof in the form of 820,000+ Google Play reviews. While not every rating is perfect, the sheer number of reviews shows its widespread use. Positive comments highlight convenience, time savings, and reliable payments. Even when users report areas to improve, such as performance on older devices, they still rely on Banco Estado APK for core transactions.

In short, trust comes from three layers: scale (25M+ downloads), credibility (state-owned bank), and proof (820K+ reviews). Together, they make Banco Estado APK one of the most reliable finance apps in Latin America.

Core Features of Banco Estado APK

Banco Estado APK isn’t just about checking balances—it’s a full banking toolkit in your pocket. Below, we’ll explore its most important features that have reshaped how millions of people handle money every day.

QR Payments for Daily Purchases

Imagine going to the supermarket and paying without touching cash or cards. Banco Estado APK supports Compraquí QR, which lets you scan a QR code at checkout and pay directly with your PagoRUT account. It’s quick, secure, and reduces errors from typing account numbers.

For small shops, cafés, or even street vendors that use Compraquí, this feature has become a game-changer, helping Chile transition toward a cashless society.

Public Transport QR Integration

One of the app’s standout features is its integration with RED Pasaje, the public transport QR system in Santiago. With just your phone, you can pay for bus, metro, and train tickets.

No need to load a transit card, no waiting in line at kiosks. Just open the app, scan the QR code, and you’re ready to travel. This level of convenience is rare in banking apps worldwide, giving Banco Estado APK a unique edge.

Secure Login with BE Pass and BE Face

Security is always top of mind when dealing with money. Banco Estado APK replaces the old coordinate card system with two modern solutions:

Together, they create a multi-layered defense that ensures only you can approve payments or transfers. This feature not only enhances security but also makes the process smoother—no need to carry physical tokens or cards.

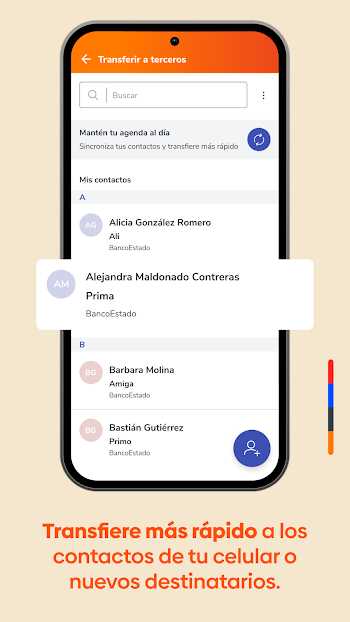

Instant Transfers and Bill Payments

Banking is not just about keeping money safe—it’s also about moving it. With Banco Estado APK, you can send money to saved contacts or new recipients instantly. The transfer goes through within seconds, giving users the speed they expect in a digital-first world.

The app also covers essential bill payments, such as electricity, water, and internet. Instead of visiting offices or using third-party services, you can manage everything from the app. For families, this means no more missed deadlines or penalty fees.

Account and Card Management

One of the most practical aspects of Banco Estado APK is the control it gives you over your accounts and cards. From the app, you can:

This level of transparency is essential for modern users who want to stay on top of their spending and detect unauthorized charges quickly.

Investments and Savings Options

Banco Estado APK goes beyond basic transactions by offering savings and investment products directly in-app. Users can explore savings accounts, fixed-term deposits, and other investment options without stepping into a branch.

For people new to investing, this is a safe entry point backed by the state bank. For experienced users, it’s a convenient way to manage portfolios on the go.

Cash Withdrawals and Remittances

Not everything is digital—sometimes you need physical cash. With Banco Estado APK, you can withdraw money at CajaVecina locations by generating a QR code. No debit card needed, just your phone.

The app also supports international remittances, enabling families to send and receive money across borders. For migrant workers in Chile or families with relatives abroad, this feature adds tremendous value.

Ticket Purchases for Travel

Traveling between cities? Banco Estado APK makes it easier by allowing you to purchase bus, train, and interurban tickets directly. It saves time and eliminates the need to buy tickets in person.

By combining transport, payments, and banking, the app creates a unified experience that few competitors can match.

Security You Can Trust

Whenever money is involved, security is the foundation. Banco Estado APK doesn’t compromise. It integrates BE Pass and BE Face to replace outdated coordinate cards. These tools provide both convenience and safety—quick logins and strong authentication.

Transactions are also protected with advanced encryption protocols, ensuring that sensitive information stays private. For users, this means confidence in every transaction, whether it’s a small QR payment or a large money transfer.

Biometric options such as facial recognition add another layer of peace of mind. You don’t need to remember long passwords—your unique biometric data ensures security without effort.

This commitment to protecting users is one of the main reasons millions trust Banco Estado APK for their daily financial activities.

User Ratings and Feedback

User reviews often reveal more than statistics, and Banco Estado APK has plenty—820,000+ ratings on Google Play. With an average score of 3.63/5, the feedback is mixed but informative.

-

Positive comments: Users praise the app for simplifying payments, making public transport easier, and reducing the need to visit branches. Many say it saves hours of their time every month.

-

Constructive feedback: Some note performance issues on low-end devices or occasional login glitches. While these concerns are valid, they rarely stop users from relying on the app for critical tasks.

The key takeaway is that even with room for improvement, Banco Estado APK delivers what matters most: secure, reliable access to essential banking services.

Banco Estado APK vs Other Banking Apps

Competition in Chile’s digital banking space is strong, with players like Santander Chile, BCI Móvil, and Banco de Chile. Yet, Banco Estado APK sets itself apart with unique advantages:

-

Public Transport Integration: QR RED Pasaje is a standout feature competitors lack.

-

State-backed Trust: As the official government bank app, it carries authority and credibility.

-

Ad-Free Experience: Unlike some private apps, Banco Estado APK doesn’t bombard users with promotions.

-

Inclusion Focus: Designed to serve both urban and rural users, ensuring no one is left behind.

While private apps may have more polished interfaces or additional premium services, Banco Estado APK wins by combining trust, inclusivity, and essential functionality.

Why You Should Download Banco Estado APK Today

When evaluating a mobile banking app, the most important question is simple: why should you download it? For Banco Estado APK, the answer lies in a combination of trust, functionality, and accessibility that few apps can match.

First, it’s an app trusted by 25 million people. That kind of adoption doesn’t happen overnight. It shows years of consistent reliability and user confidence. When millions of people already rely on the same platform, you know it delivers.

Second, the feature set is not just wide but practical. From QR shopping payments to public transport integration, Banco Estado APK focuses on the needs of real users. It doesn’t just replicate traditional banking on a screen—it adds tools that fit daily life in modern Chile.

Third, the app emphasizes security and peace of mind. With BE Pass, BE Face, and encrypted transactions, you don’t have to worry about your information being compromised. These features place the app on par with global digital banking standards.

Lastly, the app is about inclusion. Whether you live in Santiago or a rural community, Banco Estado APK provides access to banking services without requiring a physical branch. It brings financial freedom closer to everyone.

In short, downloading Banco Estado APK means choosing a secure, convenient, and inclusive way to manage your finances.

Conclusion

Banco Estado APK is not just another financial tool—it’s a comprehensive digital ecosystem that reshapes how people interact with money. With 25 million+ downloads, it has proven to be a trusted partner for everyday banking, backed by the credibility of Chile’s state-owned bank.

What makes it stand out is the balance it strikes:

-

Convenience: Pay bills, send transfers, buy transport tickets, and even invest—all from one app.

-

Security: Multi-layer authentication, encryption, and biometric access for complete safety.

-

Inclusion: Serving both city dwellers and rural users, ensuring financial access for all.

-

Trust: Supported by social proof, state backing, and millions of satisfied users.

For families, it reduces stress by handling essential services quickly. For professionals, it saves valuable time by cutting down on trips to branches. For students, it offers simple ways to pay for transport and manage daily spending.

The future of banking is digital, and Banco Estado APK shows how it can be done securely and inclusively. If you’re searching for a reliable mobile banking app that’s already trusted by millions, this is the one to download. With Banco Estado APK, you’re not just managing money—you’re gaining control, confidence, and freedom in every transaction.